Your sustainable investment partner - together building the link between property and capital

× ![]()

Integrated platform

A vertically integrated platform - all the advantages of partnering with local operation companies with the fiduciary service of an instituional qualitry investment manager

× ![]()

One-stop ESG shop

A One-stop Shop for sustainable investment in European real estate - Catella approaches sustainability as an opportunity not a compliance process

× ![]()

Custom-made offerings

Custom-made indirect offerings - Funds (open-end and closed-end), Separately Managed Account, Joint Ventures, Co-investments, and Asset Mangagement agreements

× ![]()

Established track record

An established track record across risk profiles since 2007

× ![]()

Co-investment partner

A co-investment partner for opportunistic strategies - Principal Investment

× ![]()

This is Catella

Catella is a leading finance group in property and alternative investments

Listed at Stockholm Stock Exchange, Nasdaq OMX, midcap.

× ![]()

1987

Founded in

500

employees

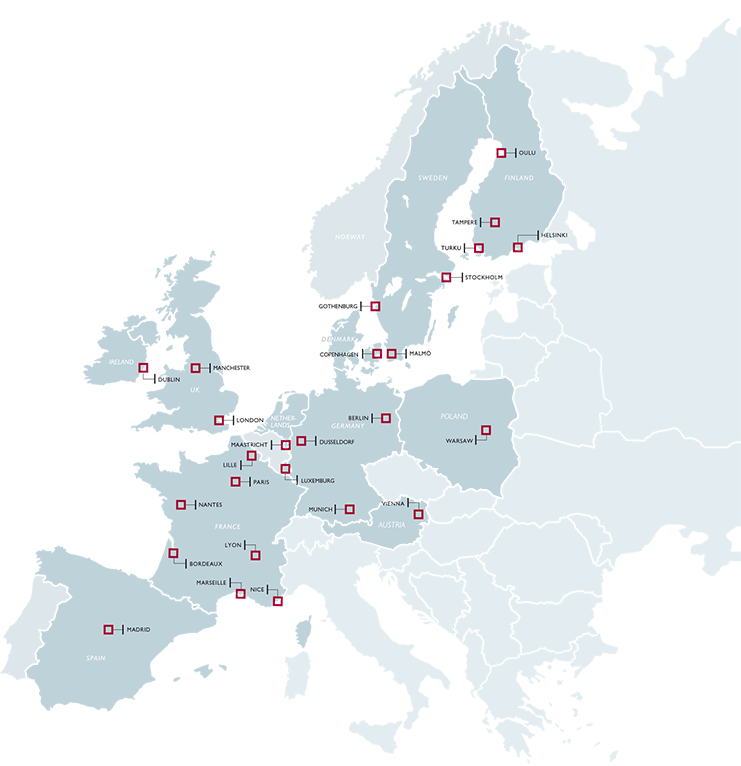

12

countries

26

offices

EUR

14Bn

Assets Under Management Q2 2025

EUR

223M

Total Income LTM

EUR

233M

Market Capitalisation June 2025

EUR

31M

Operating Profit LTM

Vision and values

Our values

- Winning together

- Entrepreneurial spirit

- Value Creation

- Empowerment

- Future-focused

× ![]()

Vision

Your sustainable investment partner –

together building the link between property and capital

× ![]()

Strategy

In recent decades, Catella's strategy has been based on offering a wide range of services, including advice relating to acquisitions and divestments combined with a strong property fund offering and management mandates to a wide spectrum of assets classes and on every important European market.

× ![]()

Business Areas

Investment Management

A Pan-European Property Investment Management

- Focused on property investments in a broad rang of risk categories

- Specialised in active investment management

- Values creation in all phases of the property investment cycle

- Extensive experience, with in depth knowledge of local property markets

- Source of Asset Management mandates, Assets into funds and Co-investment opportunities

× ![]()

Principal Investments

Direct investments and co-investments with partners in real estate projects

- Diversification and growth across geographies and assets

- Principal property investments alongside partners and external investors

- Investments through subsidaries and associated companies with the aim of generating an on average IRR of 20%

- Source ot Assets into funds, Asset Management mandates, Project Development and Co-investment opportunities

× ![]()

Corporate Finance

A leading European Corporate Finance advisor in Property

- High-end advisory and corporate finance services in property

- Extensive local property market knowledge and international capacity

- Combining property and investment expertise - acting as the link between property and capital

- Source to buy and Sell Brokerage, Valuation, research, Debt Advisory and investment opportunities

× ![]()

Contacts

Group

Gianluca Romano

Head of Capital Raising & Client Relations

Direct: +44 75 576 703 74

Download vCard