At Catella Investment Management GmbH (CIM), we take responsibility for the environment and society while fulfilling our fiduciary duties and addressing the needs of our clients. Managing over €10 billion in real estate assets across Europe, we are committed to driving sustainable real estate investments that create lasting value for communities.

ESG Objectives

We integrate Environmental, Social, and Governance (ESG) factors into our decision-making to address risks and opportunities responsibly. Guided by the Paris Agreement and internationally recognized standards such as the UN Principles for Responsible Investment (UNPRI) and OECD Guidelines, we strive to deliver market-leading ESG standards across funds and assets while promoting transparency and alignment among stakeholders.

Environmental

As a responsible real estate investor and an asset manager, we recognize our duty to minimize the negative environmental impact of our properties and contribute to their positive influence.

Social

We are dedicated to creating a workplace that upholds universal human and labour rights, abides by relevant laws and agreements, and provides fair compensation and working conditions.

Governance

Good governance, compliance, and risk management are an integral part of our transparent and sustainable approach, as well as being the foundation of good business ethics.

Our Sustainability Journey

CRIM and CREAG (now CIM) have been growing in parallel for over a decade. Their ESG strategies have been closely interlinked and, in many cases, co-developed. Also from an ESG perspective, the merger of these companies is a natural outcome of years of close collaboration.

Partnership with C Change

By advocating for sustainability as the founding fathers and sponsors of C Change, we aim to incorporate long-term intrinsic values that are often overlooked in traditional investment decision methodologies.

Designed to advance decarbonisation in the European real estate sector, C Change is a platform that inspires collaboration for a greener future. By bringing together experts from across the industry, the programme breaks down obstacles, shares knowledge, and drives innovation to fast-track impactful solutions for the benefit of both the planet and the property sector. At its core, C Change is about delivering tangible progress.

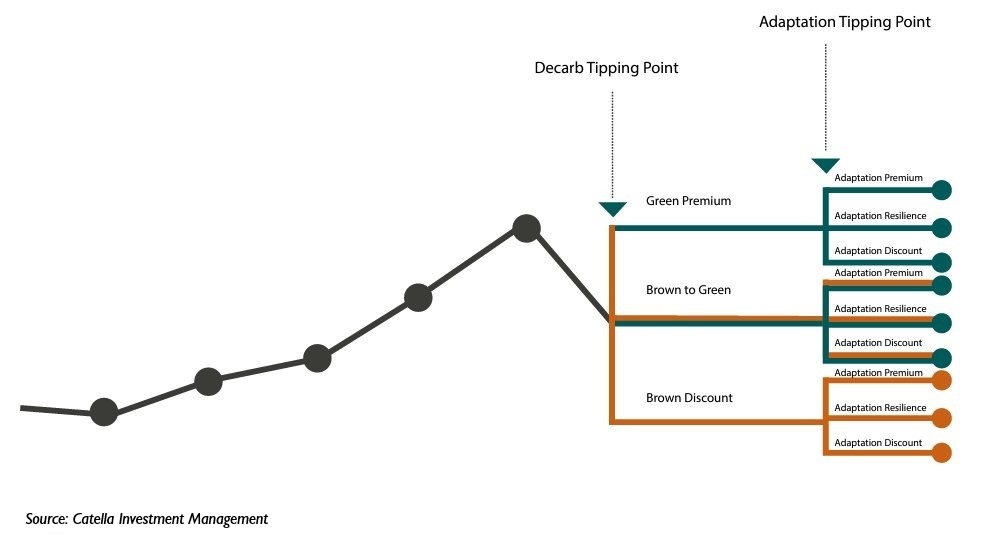

The Epsilon Great Transformation of Real Estate Markets

The concept of Epsilon, introduced in the report The Epsilon Great Transformation of Real Estate Markets in the European Residential Vision 2024, highlights the trifurcation of real estate investment valuations along alternative pathways, driven by climate change mitigation and decarbonisation efforts. This approach was developed by Catella as part of the Urban Land Institute's 'C Change' initiative, aimed at creating a standardized methodology for assessing climate mitigation risks within property valuations.