Catella is a leading specialist in property investment with a presence on ten geographical markets in Europe. The business area offers institutional and professional investors attractive, risk-adjusted returns through regulated property funds and asset management services through two service areas: Property Funds and Asset Management.

Property funds

Property Funds offers specialised funds with various investment strategies such as risk and return level, property category and location. Through 20 specialized property funds, investors gain access to fund management and efficient allocation across various European markets.

× ![]()

Asset Management

Through the Asset Management service segment, Catella offers asset management to property funds, other institutions, family offices and high net worth individuals. Through the strong synergies that exist within the Group, Catella offers investment opportunities in development projects at an early stage through Principal Investments and the Project Management service area. Catella identifies development opportunities for land and properties, arranges project financing, participates in co-investments and carries out sales once a building permit is obtained or the project is completed. These projects can also be transferred to the Asset Management service area after completion.

× ![]()

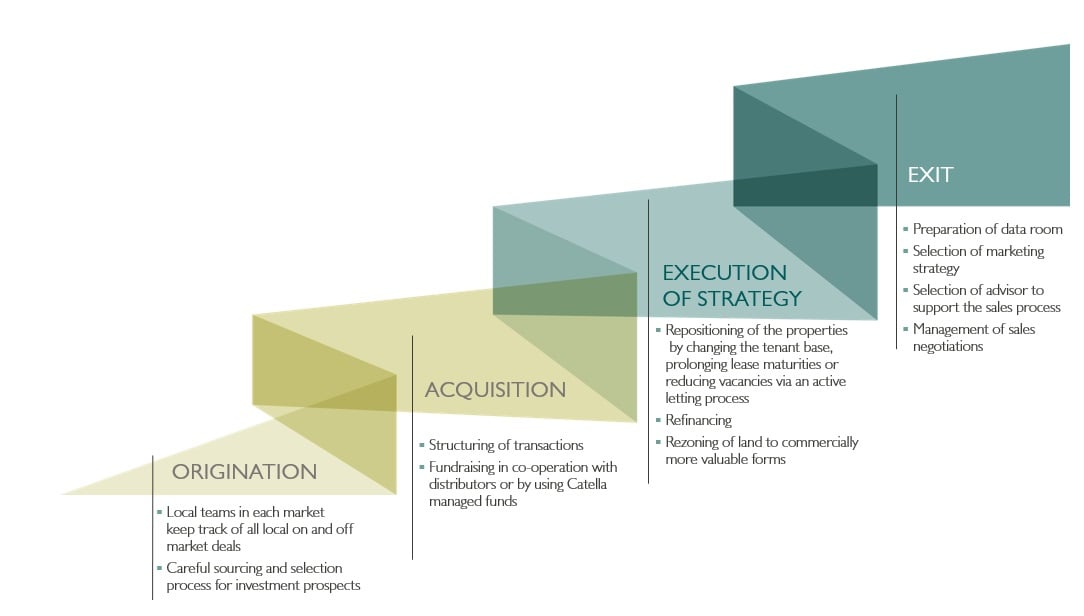

Value-creating business model

In summary, Catella creates value in all phases of the process - from identification and acquisition of projects to financing, strategic management and, ultimately, sale. Operations are run by local teams across Europe who together offer Catella’s clients comprehensive knowledge of local property markets combined with European reach.

× ![]()

Find us in your country

Focus in 2025

Catella’s strong pan-European platform and strong investment strategy offering entails opportunities to continue attracting the interest of investors with an international focus.

In the wake of many successful growth years, Investment Management is looking ahead at further, carefully selected opportunities for expansion. The business area has high potential for continued organic growth through further developing the fund offering in new investment segments and markets and scaling up existing products. The market for asset management in combination with the synergies within the group are a integral part of our offering and we see increasing demand for value creative management approach.

× ![]()